Cost of Production

Originally written February 1, 2006 | Last updated

February 23, 2014

"Careful attention to all costs generally means good profits can be achieved

with a wide range of cropping systems."

Cost of Production Worksheets

Variable versus Fixed Costs

|

|

Cash cost

|

Non-cash cost

|

|

Variable cost

|

Fuel, seed, fertilizer, herbicides, equipment repair, hired labor

|

Some tractor depreciation and interest

|

|

Fixed cost

|

Property tax, insurance, self-employed labor

|

Some tractor depreciation, implement depreciation and interest, land charge

|

Cash costs involve actual cash transactions.

Non-cash costs include expense items such as depreciation, which are not

associated with an actual cash transaction.

Variable costs increase (or decrease) as use increases (or decreases).

Fixed costs remain constant as use increases.

Fuel, seed, fertilizer and herbicide purchases are cash costs that vary with the

number of acres farmed. Property tax is a cash cost that is fixed because

it is incurred whether or not the land is farmed.

Because tillage equipment depreciation and interest are functions of age

rather than use, they are fixed, non-cash costs. Equipment depreciation occurs whether

or not the implement is used. Tractor depreciation is a partially fixed and

partially variable non-cash cost. Fixed depreciation occurs on tractors as they

age, regardless of use. Variable depreciation occurs on tractors as they are used

more intensively. To estimate farm machinery costs use: http://www.apec.umn.edu/faculty/wlazarus/

Land charge is a non-cash cost of land ownership. Principal and interest

payments are cash expenditures associated with land ownership. Land charge or interest,

when used to estimate the cost of production, is the value of the land farmed times

the rate of return that could be gained if the land were sold and the money invested

elsewhere. Land charge is a fixed cost incurred whether or not a lien exists on

the land and whether the land is farmed or left idle.

Hired hourly labor is a cash cost that increases with the number of acres

farmed or cropping activities performed. Self-employed and salaried labor

is fixed because farmers have a certain cost of living that must be met regardless

of how many acres are farmed. Self-employed and salaried labor is a cash cost that

does not necessarily change with the number of acres farmed.

|

Examples of Variable Costs

|

Examples of Fixed Costs

|

- Seed

- Inoculants

- Fertilizer

- Herbicide

- Insecticide

- Other chemicals

- Crop insurance

- Custom work

- Drying

- Irrigation

- Equipment

- Miscellaneous

- Interest

|

- Management

- Equipment

- Land

- Taxes

- Other

|

Developing budgets

UWEX Software: ABCS Simulator (Available from the Center for Dairy Profitability)

Budgets on a

per acre cost basis are a powerful tool for assisting farm management.

A listing of inputs and prices helps estimate how much operating capital is needed

for production. An estimate of the

per bushel cost of production is useful

in making effective marketing decisions. Crop share leases can be evaluated using

the contributions attributed to both landowner and tenant in a crop budget. The

economics of different systems, such as conservation tillage and no-tillage production,

can be compared.

Grower return = (Price x Yield) - Costs

Crop budgets are relatively simple for individual farmers to develop. They consist

of listing various field activities and the inputs associated with them, along with

prices, to arrive at an estimate of the cost of production. The step-by-step methodology

allows for quick development and easy verification to see if the breakdown is accurate.

Creating generic budgets to compare management practices. First, farmers

are likely to differ on weed management philosophy. One producer may choose tillage

as the major weed control method while another relies almost entirely on chemical

control. Any two producers using predominately chemical weed control will choose

different chemicals to use and apply them at different rates, depending on specific

field conditions.

Second, the machinery cost aspects of evaluating different tillage systems

can be confusing. Estimating the cost of eliminating a particular activity such

as disking may not be best represented by subtracting the custom rate for that activity.

Rather, decision makers need to determine what will be the change to their financial

situation. In other words, would eliminating a disking decrease their actual cost

of producing a crop? And if so, how much?

Overhead is hidden costs not easily accounted for in an operation. These

costs are usually related to overall expenses of managing a business and not directly

related to a specific crop enterprise (i.e. tools in a shop, heating the shop, etc.).

Usually overhead costs range from 15 to 50% of a budget.

Partial Budget

The partial budget is the best budget tool to evaluate a change in farming practices.

Partial Budgeting is the process of examining only those costs, returns and resource

needs that change with a proposed adjustment. The costs, returns and resource needs

of the business that are not affected by the proposed adjustment are ignored. This

technique compares added revenues and costs of the proposed change (zero tillage

seeding on all or part of the farm) with revenues and costs of the present practice.

In order to compare the systems, you must know your farm operational costs, some

fixed costs, and the potential returns from each practice.

What is your yield potential?

Establish Realistic Yield Goals

- Yield Potential of Soil

- Growing Season - Growing Degree Units

- Sub-soil Moisture

- Management Ability & Philosophy

- Attitude Toward Risk

- Willingness to Be Timely

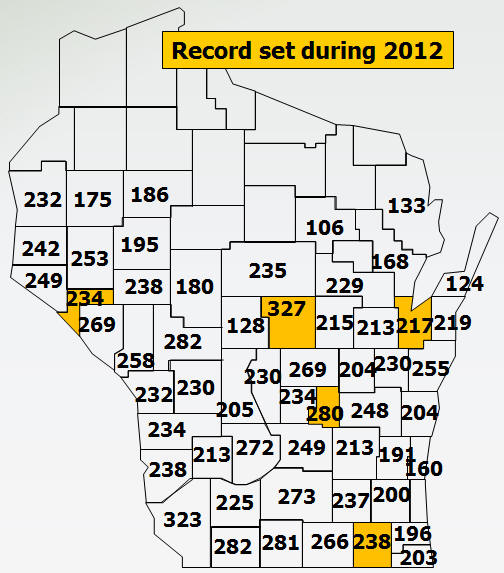

Highest recorded corn yields (bu/A) in Wisconsin counties (1983-2012). Data

includes participants in the NCGA yield contest and Wisconsin PEPS program.

How do you rank relative to other grain crop producers in Wisconsin?

USDA

Regional Cost and Return data

Wisconsin Crop Enterprise

Budgets also see Season

Computer Decision Support Systems

PEPS

Equipment References

Precision Farming database

Estimating Agricultural Field Machinery

Costs UWEX Bulletin A3510

Wisconsin's Custom Rate Guide

(updated every 2 yrs) UWEX Bulletin A3510 A3656

Soil Compaction: Causes, Concerns

and Cures UWEX Bulletin A3367

Minnesota Farm

Machinery Economic Cost Estimates University of Minnesota (FO-6696)

Minnesota Farm Custom Rate

Survey University of Minnesota